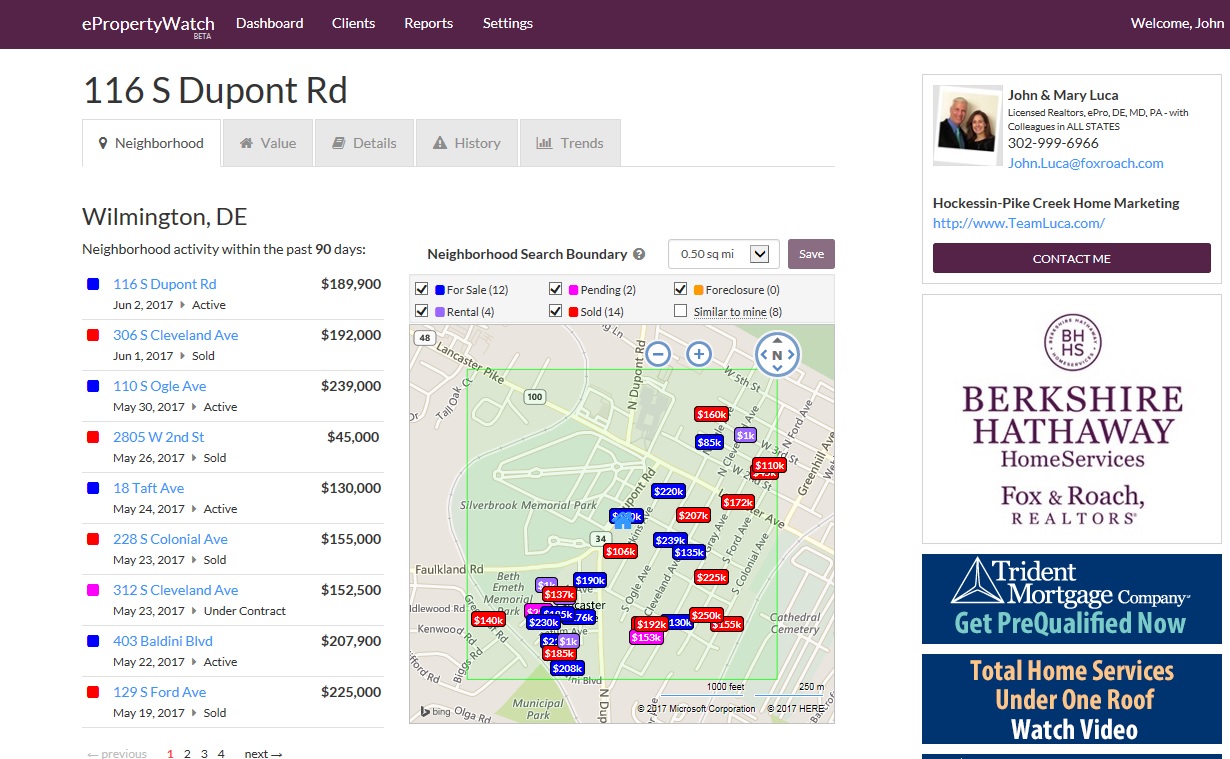

Immediate ePropertyWatch to show market activity near home/real estate

To view market activity around your home or a property you may wish to learn more about in order to purchase, simply fill out the form below and a report will immediately come to you. It will update automatically with market activity every two weeks for you as well. A sample report is below the form.

.....

How does Our National ePropertyWatch benefit YOU?

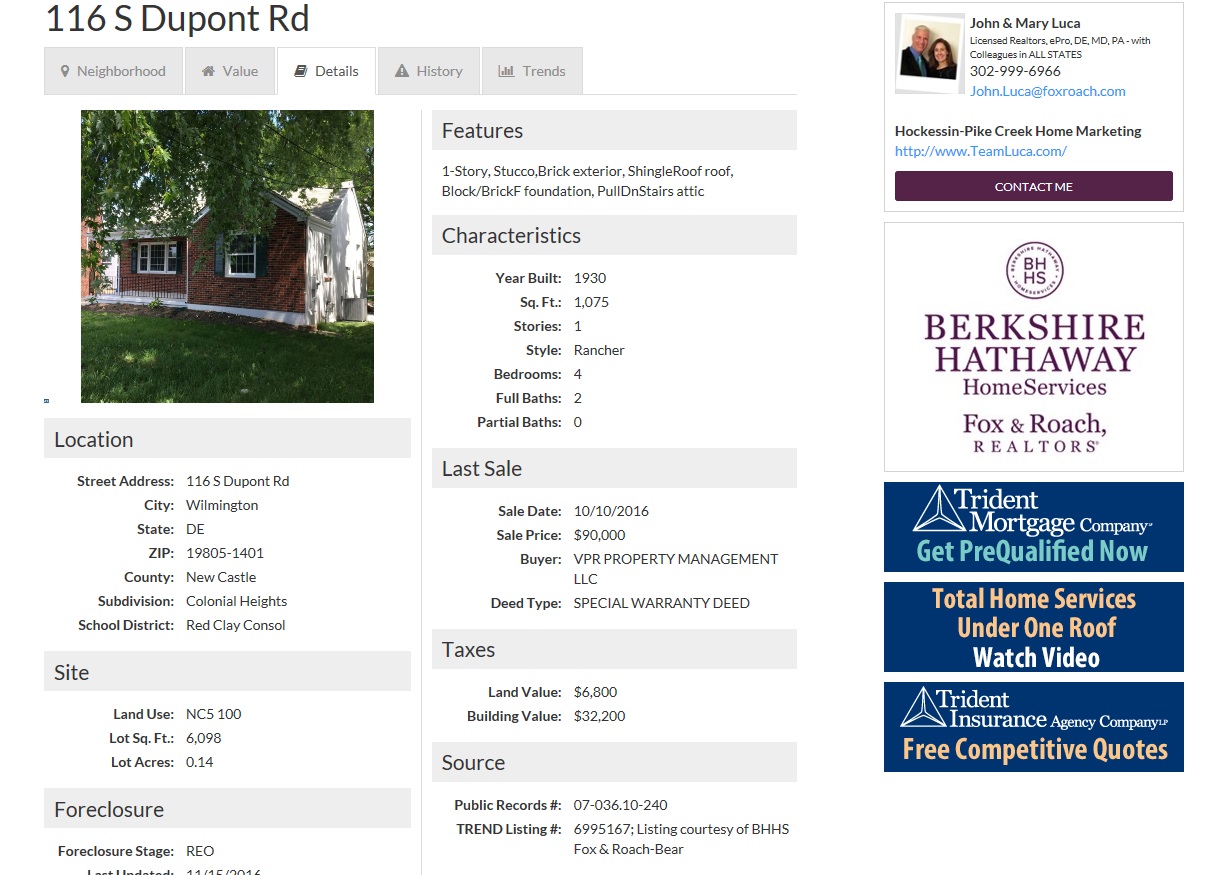

It's about you

ePropertyWatch delivers information about YOUR home and neighborhood straight to your inbox. Not some dry, dull report about your town - it's tailored just for you.

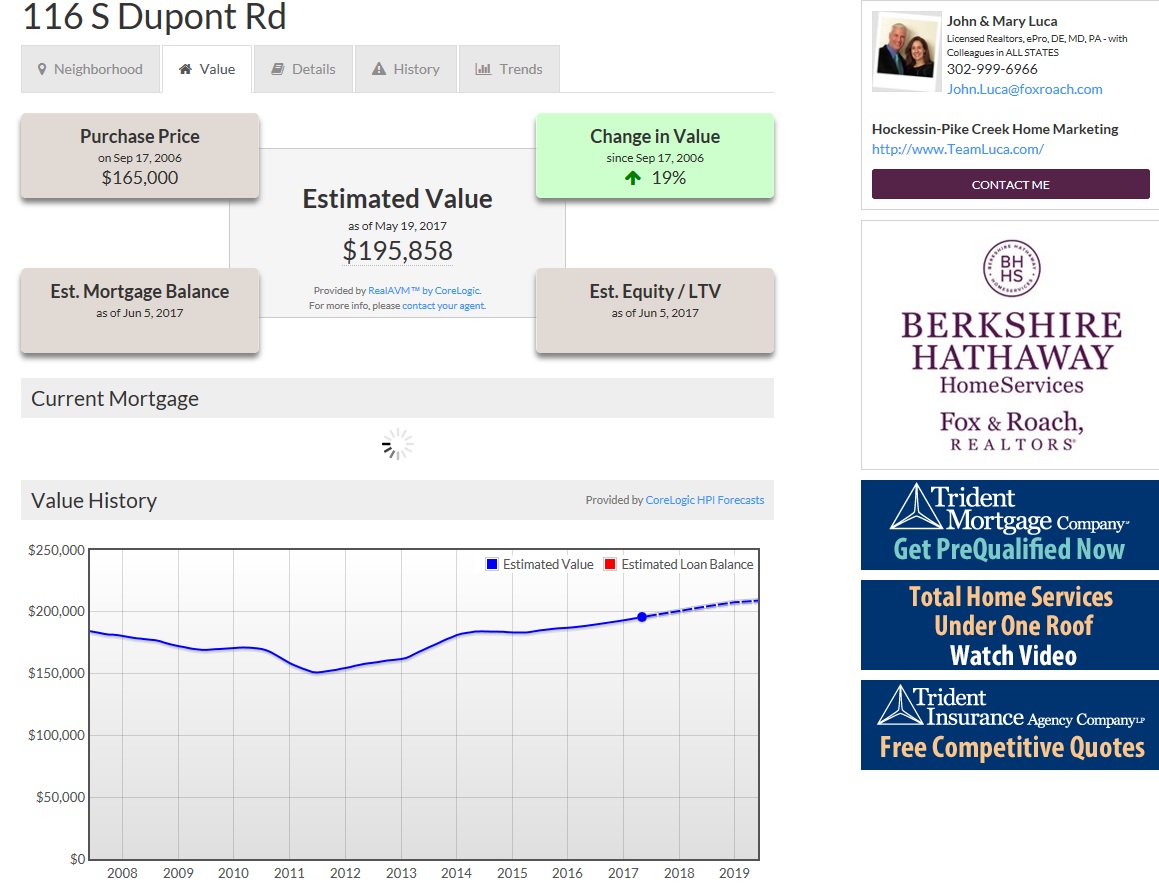

Your home's value

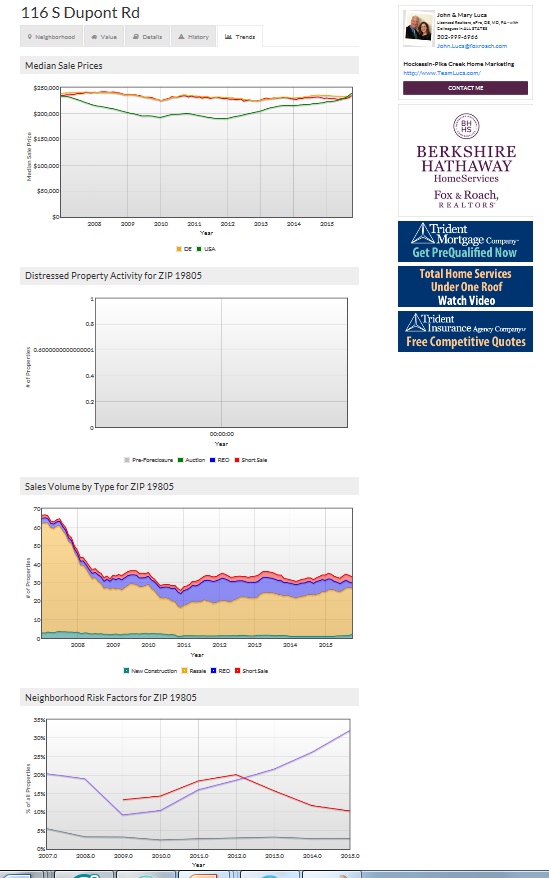

Markets are dynamic and home values are constantly changing. With ePropertyWatch, you'll keep your finger on the pulse of your home's ever changing value. After all, your home is probably your #1 asset, so we'll help you know where you stand!

Forecast

Not only will you see what your home is worth today, but you'll also see the industry's leading "home price index" forecast for what your home might be worth years from now. That's great for planning your real estate future.

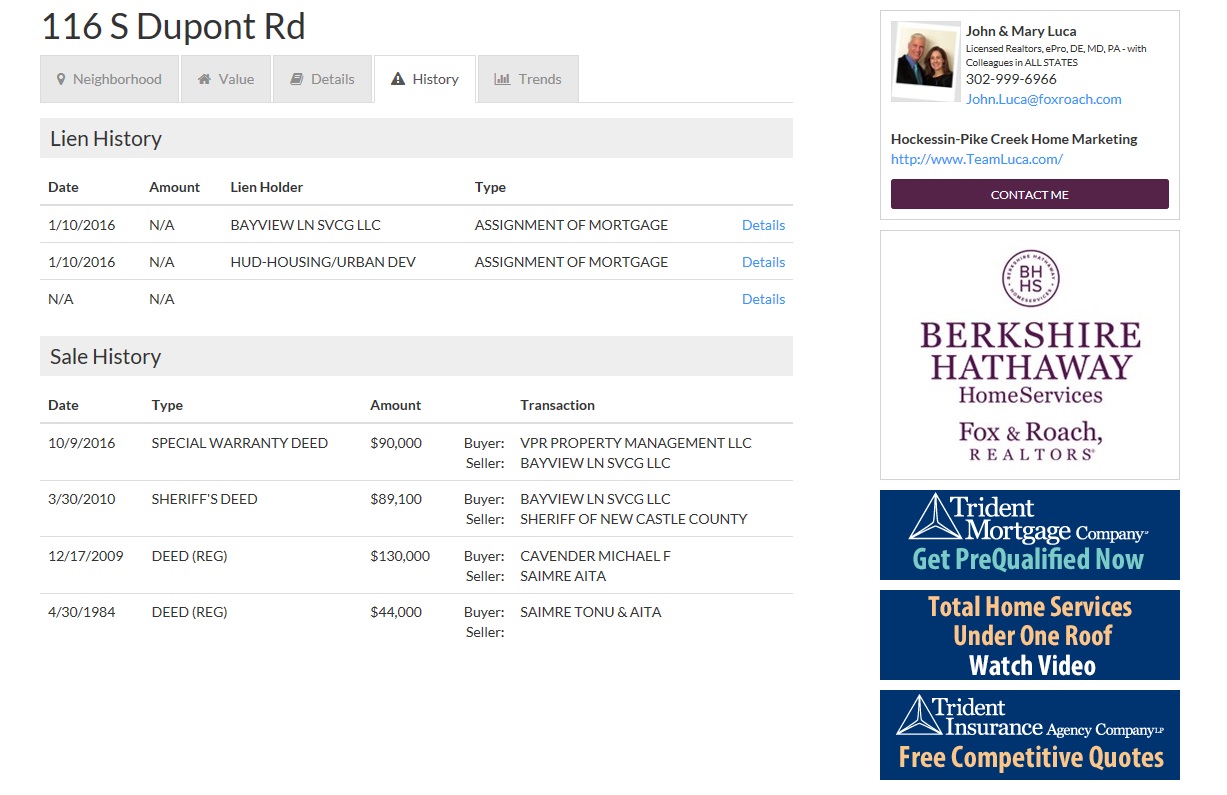

Your neighbors

With ePropertyWatch, you'll know exactly what is happening around you. From sales to rentals to foreclosures - you'll have your finger on the pulse of your neighborhood!

Much more!

Sign up for FREE Now

Here:

https://www.epropertywatch.com/widget/sponsor/jrxElKPk

or Here at bottom of page: https://www.epropertywatch.com/widget/sponsor/jrxElKPk

If you have any questions about real estate in - please contact us at 302-740-5872 and visit our websites to search for your next home or investment at whichever website you enjoy more:

We look forward to helping you,

John & Mary Luca

John - Licensed in DE, PA, MD; Mary - MBA, Licensed in DE, PA & e-Pro Certified

Berkshire Hathaway HomeServices Fox & Roach Realtors

88 Lantana Dr.

Hockessin DE 19707

Direct: 302-999-6966

Cell: 302-740-5872